2025 Social Security Maximum Taxable Earnings 2025

Blog2025 Social Security Maximum Taxable Earnings 2025 - Taxable Social Security Benefits Calculator (2025), In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. In 2025, the social security tax limit rises to $168,600. Maximum Wages For Social Security 2025 Inessa Catrina, However, the annual increases may not be sufficient to sustain the program in future years. For 2025, the social security tax limit is $168,600.

Taxable Social Security Benefits Calculator (2025), In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. In 2025, the social security tax limit rises to $168,600.

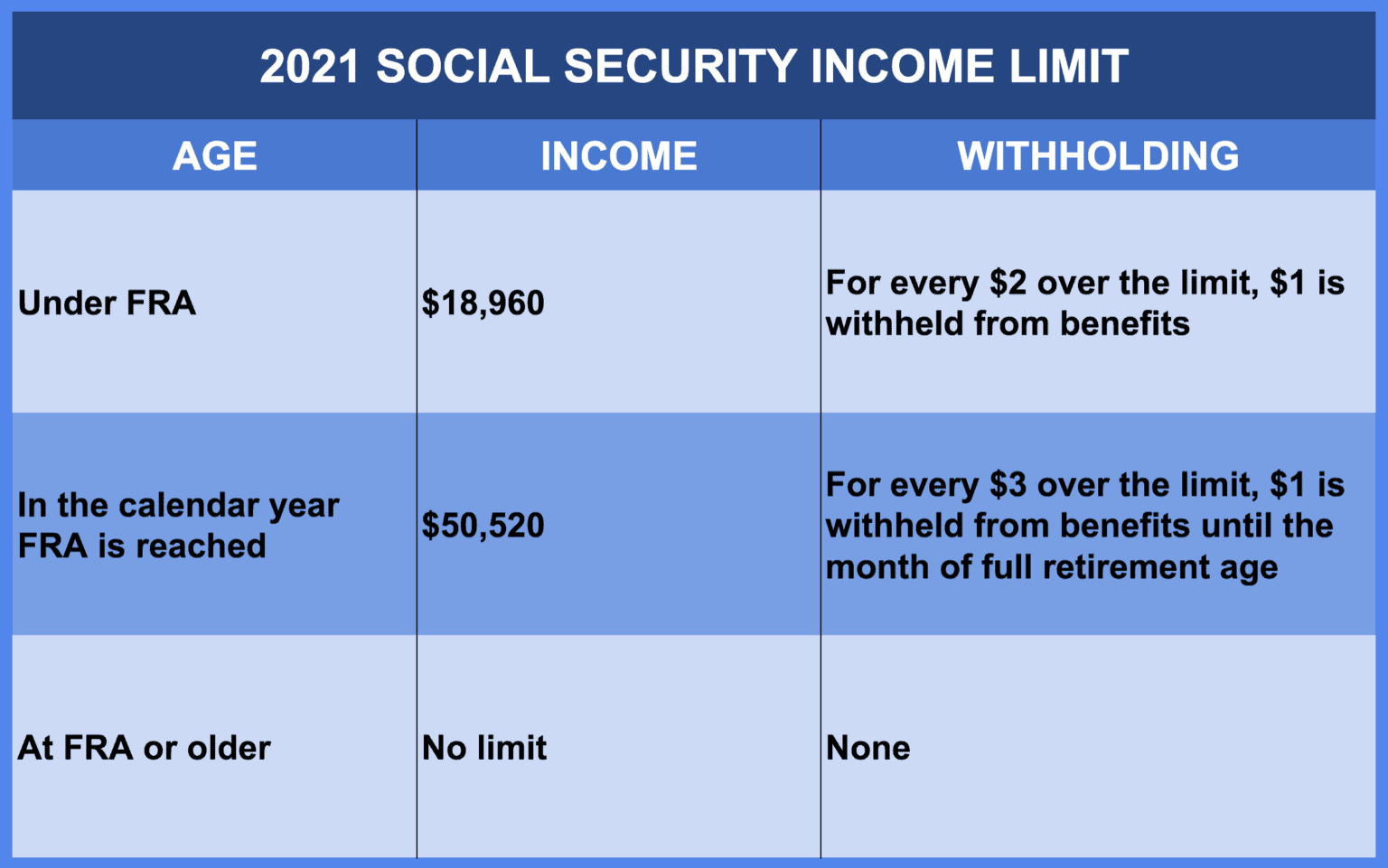

Taxable income is calculated by subtracting. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed.

We call this annual limit the contribution and benefit base.

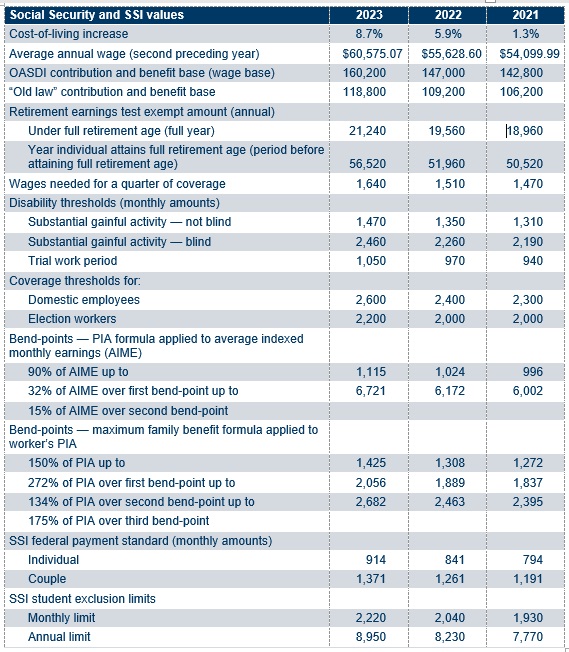

Social Security Withholding 2025 Binny Cheslie, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. Listed below are the maximum taxable earnings for social security by year from 1937 to the present.

5.2 Increase to Social Security Maximum Taxable Earnings in 2025 YouTube, We call this annual limit the contribution and benefit base. The maximum social security employer contribution will.

2025 Social Security Wage Cap Calculation Kiley Merlina, Workers earning less than this limit pay a 6.2% tax on their earnings. Only the social security tax has a wage base limit.

SOCIAL SECURITY UPDATE 168,600 New Social Security Maximum Taxable, Individuals with multiple income sources. That's because the irs adjusts the maximum earnings threshold for social security each year.

2025 Earnings Limit For Social Security 2025 Corri Doralin, This amount is also commonly referred to as the taxable maximum. So, if you earned more than.

Maximum Taxable Amount For Social Security Tax (FICA), This amount is known as the “maximum taxable earnings” and changes each. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

2025 Social Security Maximum Taxable Earnings 2025. For earnings in 2025, this base is $168,600. In 2025, the social security tax limit rises to $168,600.

In 2025, you can earn up to $22,320 without having your social security benefits withheld.